CAIS

Founded Year

2009Stage

Private Equity | AliveTotal Raised

$398MValuation

$0000Missing:CAIS'sProduct Demo & Case Studies

Promote your product offering to tech buyers.

Reach 1000s of buyers who use CB Insights to identify vendors, demo products, and make purchasing decisions.

ESPs containing CAIS

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The alternative investment market encompasses any investment opportunity outside of traditional stocks and bonds, such as private equity, hedge funds, real estate, digital assets, and more.

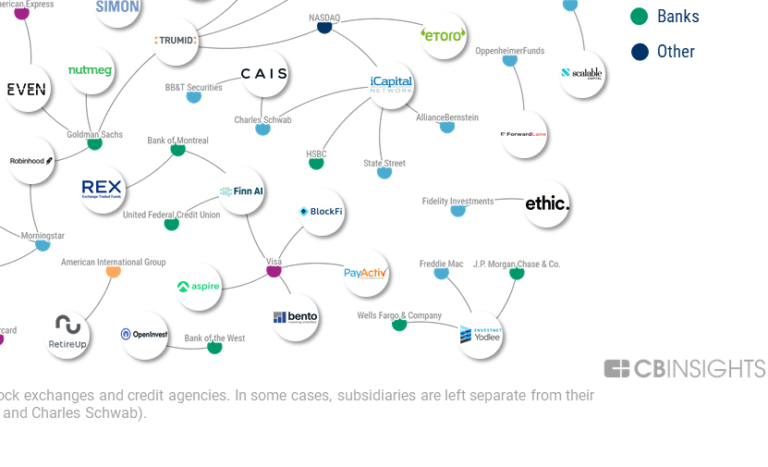

CAIS named asLeader among 9 other companies, includingiCapital Network,Clarity, andClimate Trade.

Missing:CAIS'sProduct & Differentiators

Don’t let your products get skipped. Buyers use our vendor rankings to shortlist companies and drive requests for proposals (RFPs).

Research containing CAIS

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned CAIS in2 CB Insights research briefs, most recently onOct 31, 2022.

Expert Collections containing CAIS

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

CAIS is included in4 Expert Collections,includingUnicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,205 items

Wealth Tech

2,154 items

A category of financial technology that is digitizing & streamlining the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Fintech

7,750 items

US-based companies

Fintech 250

249 items

CB Insights' annual list of the 250 most promising private fintech companies in the world. FTX was removed after declaring bankruptcy on 11/11/2022.

LatestCAISNews

Feb 4, 2023

大衛跳Artigo | 04/02/2023 12:30 apo怪獸estado num empreendimento habitacional, em construção, em Câmara de Lobos, no âmbito do PRR, Miguel Albuquerque rumou ao Paul do Mar onde, ainda acompanhado de Pedro Fino, se juntou ao autarca local, Carlos Teles. O objetivo foi observar in loco as abras realizadas no varadouro do Paul do Mar, sendo que a renovação integral do varadouro resultou de investimento de 222.261,23 euros, comparticipado a 75% pelo Fundo Europeu dos Assuntos Marítimos e das Pescas, numa intervenção realizada em três fases, inserido num todo de intervenção no Cais do Paul do Mar. Na justificação da obra, é exaltado que “o Cais do Paul do Mar tem sido um ponto fulcral da economia da zona oeste da ilha da Madeira, dado que tem sido dinamizador não só da atividade da pesca como das atividades dedicadas às marítimo-turísticas, permitindo a acostagem de embarcações numa extensão de aproximadamente 190 metros de comprimento”, sendo que “no seu interior encontra-se uma rampa varadouro e a lota do Paul do Mar”. “Até há pouco tempo aquele cais apresentava danos consideráveis, resultantes dos fortes regimes de agitação marítima que ano após ano incidem naquele trecho de orla costeira e que precisavam ser corrigidos de forma a que a funcionalidade do porto não viesse a ser comprometida pela ocorrência de danos não reparáveis”, pode-se ainda ler. Na especificação, temos que as obras realizadas no âmbito desta reabilitação foram as seguintes: - Demolição do muro cortina danificado e reconstrução de um novo muro-cortina numa extensão de 150 metros. - Reperfilamento do manto proteção marítima do cais com os Antiferes de 20 toneladas a existentes, ao longo dos aproximadamente 150 metros de desenvolvimento: - Reforço do manto de proteção marítima do cais com a construção e colocação de 477 novos Antiteres de 30 toneladas, ao longo dos aproximadamente 150m de desenvolvimento - Reparação da superstrutura das aduelas na cabeça do molhe; - Reparação do betão com sinais de desgaste ou deterioração nas seguintes estruturas: escadas de acesso ao cais, superstrutura do cais e muro-cortina no troço que não foi demolido; - Substituição dos cabeços de amarração; - Substituição das tampas metálicas das caixas de visita da rede elétrica e enchimento e selagem das restantes caixas de visita; - Colocação de guardas metálicas no perímetro das escadas de acesso ao cais, onde já não existiam ou estavam danificadas. No seu todo, a obra de requalificação do Cais foi adjudicada a um consórcio dominado pela Tecnovia, pelo valor de 1.838.000,00 euros, tendo se iniciado em julho de 2021 e terminado um ano depois, em julho de 2022. Foram entretanto realizados trabalhos complementares, no valor aproximado de 53.500 euros, que consistiram maioritariamente na colocação de iluminação ao longo do muro cortina do cais.

CAISFrequently Asked Questions (FAQ)

When was CAIS founded?

CAIS was founded in 2009.

Where is CAIS's headquarters?

CAIS's headquarters is located at 527 Madison Avenue, New York.

What is CAIS's latest funding round?

CAIS's latest funding round is Private Equity.

How much did CAIS raise?

CAIS raised a total of $398M.

Who are the investors of CAIS?

Investors of CAIS include Hamilton Lane, Reverence Capital Partners, Franklin Templeton, Apollo Global Management, Motive Partners and 6 more.

Who are CAIS's competitors?

Competitors of CAIS include Ethic, Stableton, iCapital Network, Titanbay, Climate Trade and 11 more.

Compare CAIS to Competitors

iCapital Network provides an online platform that enables qualified investors to search and analyze hundreds of private fund managers and gain direct access to buyout, growth equity, real estate, mezzanine, infrastructure, real assets, and venture funds. Its secure online portal helps fund managers, wealth advisors, family offices, and individual qualified purchasers. The company was founded in 2013 and is based in New York, New York.

Climate Trade offers a platform that helps companies find a simple way to offset their carbon footprint. Its platform also allows firms to invest in green financial products. It was formerly known as Climate Blockchain Initiatives. The firm was founded in 2017 and is based in Valencia, Spain.

WeShareBonds meets the financing needs of SMEs by allowing investors, individuals and professionals to finance SMEs selected by a team of investment professionals.

EquityZen connects shareholders of private companies with investors seeking alternative investments.

iPampas is a WealthTech startup company providing digital/ tech-solutions for Wealth Management related industries. WeTAMP, the core product, is a BPaaS solution and RPAs platform specially designed for Wealth Management industries. By implementing AI/ RPAs/ APIs technologies and achieving digitalization, iPampas assists its clients to build a better business scenario and re-define the traditional wealth business structure.

Ethic is a technology-driven, sustainable asset manager assisting institutions to create passive investment portfolios specific to their values and financial goals. Its technology solution allows wealth advisors and institutional investors to create custom, optimized, tax-efficient sustainable equity portfolios, and automates the creation of portfolios designed to outperform in sustainability. It was formerly known as Simplifund. The company was founded in 2015 and is based in New York, New York.

Discover the right solution for your team

The CB Insights tech market intelligence platform analyzes millions of data points on vendors, products, partnerships, and patents to help your team find their next technology solution.