信用芝麻

成立一年

2010年階段

係列G。 |活總升高

1.7564億美元最後一個舉起

5100萬美元 |1年前馬賽克得分

過去30天+40點

信用芝麻的產品視頻

信用芝麻的產品與差異化

看信用芝麻的產品以及其產品如何與替代方案和競爭對手區分開

-

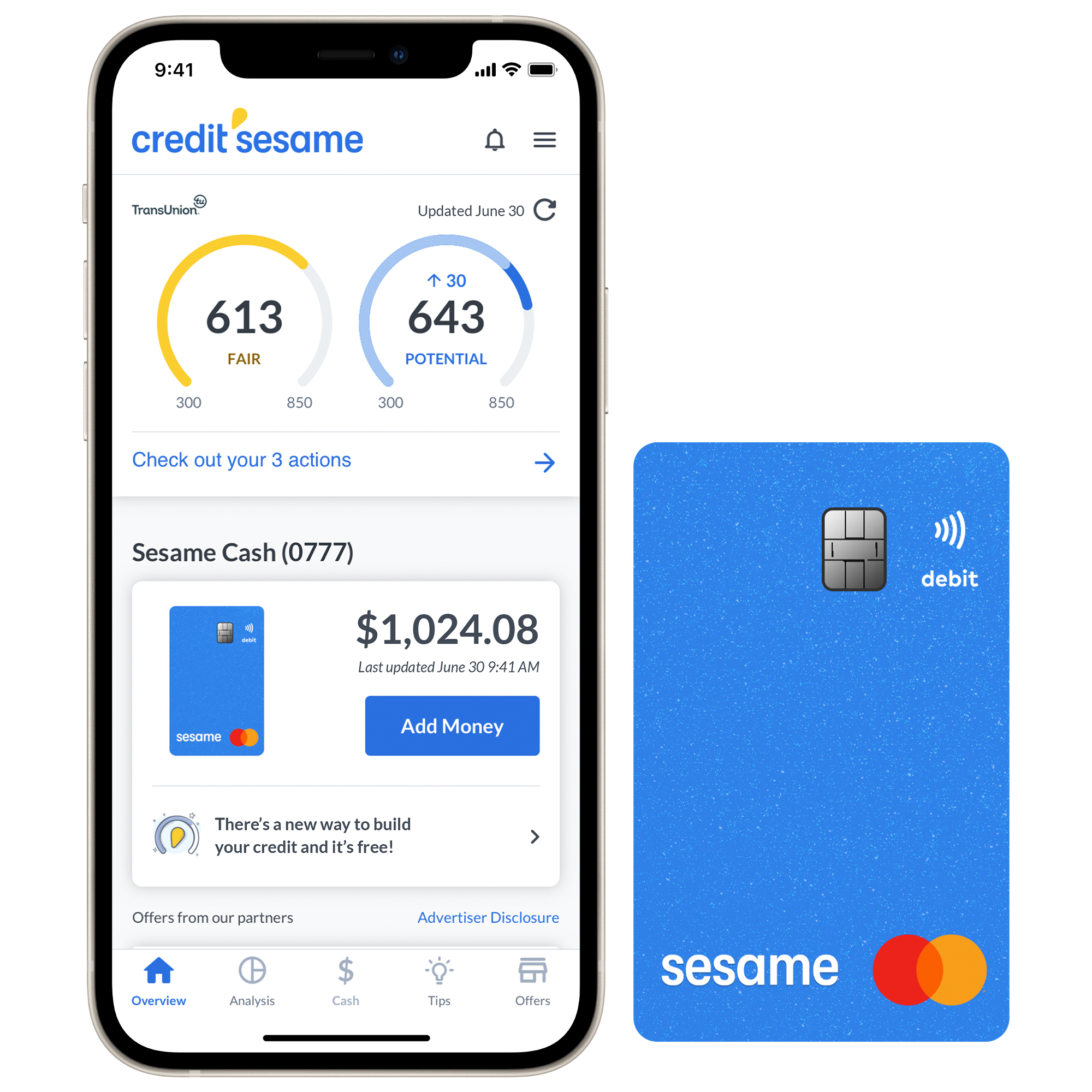

芝麻現金

芝麻現金是第一家信用建設者銀行服務,允許消費者使用其借方來建立和建立信貸,並在他們的情況下用現金獎勵他們。

分化

使用芝麻現金,信用芝麻提供了第一張也是唯一的借記卡:積極幫助消費者使用其銀行帳戶和借記卡獲得信用卡的信用卡福利 -

-

訂閱以查看更多

我們的使命是使每個組織都能就技術做出更明智的決定。無論是找到改變遊戲規則的供應商還是了解新市場,CB Insights都會更容易,更快,更聰明。188bet游戏所有這些都是由技術中最聰明,最努力的團隊成為可能的。訂閱以查看更多。

分化

我們的使命是使每個組織都能就技術做出更明智的決定。無論是找到改變遊戲規則的供應商還是了解新市場,CB Insights都會更容易,更快,更聰明。188bet游戏所有這些都是由技術中最聰明,最努力的團隊成為可能的。訂閱以查看更多。

-

訂閱以查看更多

我們的使命是使每個組織都能就技術做出更明智的決定。無論是找到改變遊戲規則的供應商還是了解新市場,CB Insights都會更容易,更快,更聰明。188bet游戏所有這些都是由技術中最聰明,最努力的團隊成為可能的。訂閱以查看更多。

分化

我們的使命是使每個組織都能就技術做出更明智的決定。無論是找到改變遊戲規則的供應商還是了解新市場,CB Insights都會更容易,更快,更聰明。188bet游戏所有這些都是由技術中最聰明,最努力的團隊成為可能的。訂閱以查看更多。

包含信用芝麻的研究

從CB Insights情報部門獲取數據驅動的專家分析。188bet游戏

188bet游戏CB Insights情報分析師在4 188bet游戏CB Insights研究簡介,最近2021年12月8日。

2021年12月8日

55多個創業公司改變全球抵押貸款行業

2021年10月5日報告

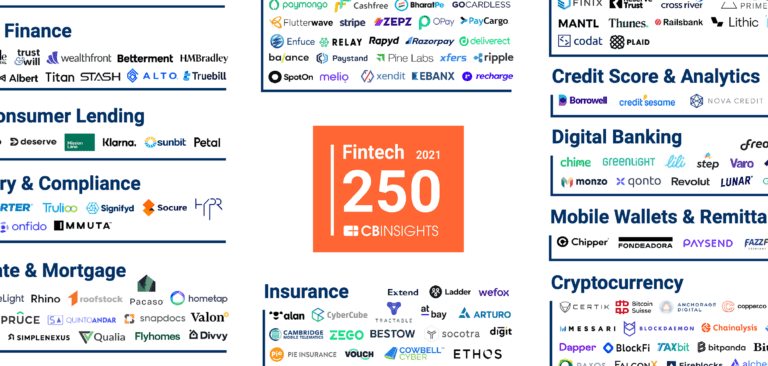

金融科技250:2021年的頂級金融科技公司

2021年8月17日

這家紅杉資本支持的挑戰者銀行籌集了7.5億美元來擴展運營

2021年6月30日

這家Invus集團支持的公司籌集了2億美元,以幫助消費者獲得信貸包含信用芝麻的專家係列

專家收集是分析師策劃的列表,這些清單突出了您在最重要的技術空間中需要了解的公司。

信用芝麻包含在6個專家係列,包含抵押技術。

抵押技術

218個項目

這裏的公司簡化並數字化抵押貸款流程。收集包括直接貸方,抵押經紀人,貸方的流程優化技術,以及在整個搜索階段支持借款人的工具。

財富技術

1,707個項目

一類金融技術正在數字化和簡化財富管理的交付。包括:為散戶投資者和顧問提供支持技術和被動財富管理的技術工具的初創公司。

數字貸款

1,511項

該係列包含提供用於個人或企業使用貸款的替代方法的公司以及為貸方提供軟件的公司,以供申請,承銷,資金或貸款收款流程。

技術IPO管道

282個項目

跟蹤和捕獲公司信息和工作流程。

金融科技

7,344個項目

美國公司

金融科技250

500個項目

250家改造金融服務的頂級金融科技公司

信用芝麻專利

Credit芝麻已提交了2項專利。

最受歡迎的3個專利主題包括:

- 計算機網絡安全

- 計算機安全

- 數據安全

申請日期 |

授予日期 |

標題 |

相關話題 |

地位 |

|---|---|---|---|---|

|

9/14/2012 |

10/13/2020 |

財務數據供應商,網絡硬件,計算機網絡安全,以太網,計算機網絡 |

授予 |

申請日期 |

9/14/2012 |

|---|---|

授予日期 |

10/13/2020 |

標題 |

|

相關話題 |

財務數據供應商,網絡硬件,計算機網絡安全,以太網,計算機網絡 |

地位 |

授予 |

最新的信用芝麻消息

2022年5月19日

此iframe包含處理Ajax驅動重力表格所需的邏輯。Shazia Virji已經在金融科技的十多年裏。她在年輕時就對金融服務產生了興趣。她的父母於1980年代從東非坦桑尼亞移民到美國。進入一個新國家後,他們的許多早期掙紮源於對金融體係的認識和知識有限。“Growing up in that environment of not being able to do some of the things that my friends were doing, and seeing my parents’ struggles of paying bills, and just having enough to go out on family vacations and things like that – it really gave me the motivation to educate myself on the financial system,” said Shazia. “Going to college, I had to take out my first student loan, and really figure out what borrowing and debt was all about. I learned a lot very quickly, and realized I wanted to empower people – like my parents and like myself – to fully understand the financial system and how it impacts not just immigrants, but millions of Americans who deserve better financial opportunities.” After graduating from college, Shazia became a wealth management advisor at Ameriprise Financial, helping clients with their assets and investments. It was a good foundational opportunity for her to learn about how financial markets work. But at the end of the day, her role involved “making wealthy people wealthier”, which didn’t sit well with what she felt was her personal mission, and the reason why she joined financial services. So in 2012, she decided to pivot into the fintech world by joining Intuit Mint as a marketing manager, and helping customers with financial tasks like budgeting and paying their bills on time. Three years later, Shazia’s fintech experience enabled her to join Credit Sesame’s business development team. At that time, the company was only five years old, with around 30 to 40 employees. This allowed her to witness the evolution of the company and to grow alongside it. Having been a part of Credit Sesame for almost seven years now, Shazia has worn many hats at the firm. Last April, she was promoted to GM of credit services. The role involves setting the strategic vision for the firm’s credit services unit, which primarily provides customers with guidance and recommendations on credit and financial wellness. “We’re helping to democratize financial wellness for millions of Americans, and improve their credit health,” said Shazia. “It’s personally rewarding for me to see the effect of my work through customer testimonials, and hearing stories about how we’ve helped people get through the toughest financial situations in their lives. That is what motivates me to get up and go to work every day.” Here’s what it’s like to spend a day in Shazia’s life. The workday I usually wake up around 6 or 6:30 in the morning, so I can jump-start my day and be available for members of our team who are in a different time zone – we have quite a few folks who are on the East Coast. The first thing I do when I wake up is check my emails and slack messages on my phone, in case there’s anything urgent that needs my attention. Of course, I need caffeine in order to function, so the next thing I do is make myself a big cup of tea. I drink that while listening to The Wall Street Journal podcast — I like to catch up on the markets and any news that’s developed in the US or around the world, just to make sure I’m updated on what’s going on outside of my own little bubble. After that, I’m finally ready to open my laptop and review my to-do list for the day. I’ve actually made it a habit to block my calendar before 9 am and after 4 pm, so no one can schedule meetings with me during those times. This allows me to gather my thoughts and prepare for the day ahead in the morning, and also gives me time at the end of the day to reflect and respond to any messages I received during the day. I start the week with our staff meeting, where we collaborate as a team on any issues or blockers that need to be addressed before the week really kicks off. I think one of the most valuable skills a team can have is the ability to adapt and be proactive to the changing needs of its business. So we’re always asking questions like, ‘What’s the next big thing in our industry? And the one after that?’ We try to think two steps ahead, instead of just focusing on our day-to-day operations. Every week, I also have around 5 to 10 one-on-ones with different team members and cross-functional stakeholders. I find these to be the most critical meetings, as they help ground me in the work that’s taking place at all levels of the organization. But I also think they provide a great social opportunity, because a lot of us are working from home right now, and it’s not as easy to just run into people in the hallway or in the kitchen. So I feel like proactively scheduling time over video chat is really important – especially with people that aren’t on your team and don’t report to you. It’s good to catch up and say hello, even if you’re just talking about your family or what’s going on in your life. I also make it a priority to set aside an hour for lunch every day. I try to be diligent about taking a break mid-day, because I’m in back-to-back meetings all day. It’s a good opportunity to just stop for a minute, nourish myself, and eat something healthy – usually it’s a big salad. In the afternoon, I need my second dose of caffeine – so I either make a latte at home or go grab some Blue Bottle from the coffee shop around the corner. I usually prefer getting out of the house to get some fresh air and stretch my legs. At the end of each day, I like to review the priorities and intentions I set for myself in the morning. On a good day, I can close my laptop without any of those nagging feelings about the tasks I wish I had completed, but didn’t get to. After work In the evening, I usually clear my head with a walk or by hopping on the Peloton for a quick ride. I finish off the evening with dinner made at home or ordered in. A lot of times it’s ordered in, because it does get pretty tiring by the end of the day. I usually cap off my night with journaling for a few minutes to reflect on the day. It’s also good at keeping me off my phone before bedtime – I try not to let work stuff bother me at night. I’m usually asleep by 10:30 or 11. And that’s my day in a nutshell! Weekends and free time I’m a Bay Area native – we have a bunch of really great sports teams, like the Warriors, the 49ers, the Giants, and the Oakland A’s. When it’s basketball season – which is usually October through May or June, if we make it to the playoffs or finals – I’m usually at the games or watching them at home, which takes up a lot of my evenings. I love having that outlet, something to do outside of work that keeps me really energized. I’m also really into music and art – I love attending live orchestras and going to art exhibits. That gets me more into that creative mindset, which helps unlock a different part of the brain than the “logic” part I’m using for most of the day at work. Currently, I’m also doing a part-time MBA at Berkeley’s Haas School of Business. So on the weekends, I’m typically attending classes in Berkeley and hanging out with my classmates. I’ve taken some entrepreneurship, strategy, and leadership classes that are really relevant and timely for the work I’m doing at Credit Sesame. At times it can be a bit of a challenge to juggle work with studies, but I feel like I’ve become pretty good at time management. Plus, I truly believe in lifelong learning, which is something that always helps me stay motivated. 0 comments on “‘We try to think two steps ahead’: A day in the life of Shazia Virji, GM, Credit Services at Credit Sesame” You must be logged in the post a comment.

信用芝麻網絡流量

信用芝麻排名

信用芝麻何時成立?

Credit Cesame成立於2010年。

信用芝麻總部在哪裏?

Credit芝麻總部位於山景城卡斯特羅街444號。

信用芝麻的最新融資是什麼?

Credit芝麻的最新資助回合是係列G。

芝麻的信貸增加了多少?

信用芝麻總計1.7564億美元。

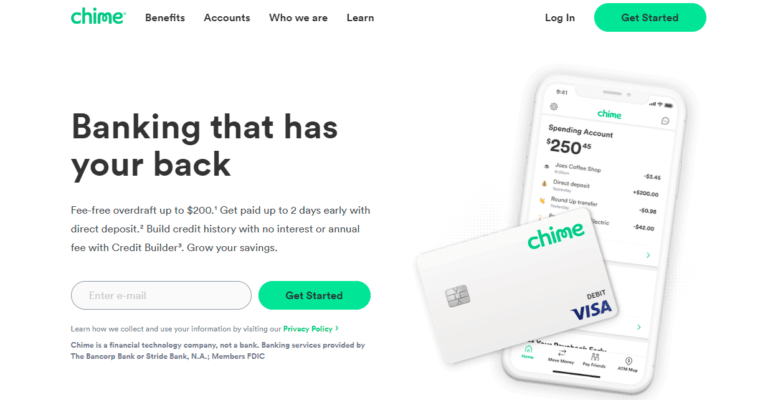

誰是信用芝麻的競爭對手?

信用芝麻的競爭者包括Nerdwallet和6個。

信用芝麻提供什麼產品?

Credit芝麻的產品包括芝麻現金,還有2個。

你也許也喜歡

CreditMantri的在線平台旨在使貸方和借款人能夠更好地了解彼此。該平台利用數據來支持有效的信用決策。CreditMantri結合了傳統數據和替代數據,使消費者能夠創建其信用資料,以了解其信用潛力。客戶可以訪問其信用評分,了解如何改善信用健康,並發現最適合其信用資料的產品。

Credit.com通過提供易於閱讀的評論和專家分析來幫助用戶比較並選擇最佳信用報告和信用評分。

值得提供數字優先,以移動設備為中心且高度可配置的基於API和SDK的信用卡解決方案。除了金融機構,金融科技,現代消費者品牌,大學和協會外,還應使用機器學習和替代數據獲得權力共同品牌的信用卡計劃。該公司成立於2013年,總部位於加利福尼亞州的帕洛阿爾托。

Varo Bank通過移動應用程序提供借記卡,存款和貸款產品,並將圍繞24/7的數字金融教練建造,該教練將提供見解,分析支出和實時預算。

Empower是一款移動銀行應用程序,可提供一套個人融資解決方案,包括自動儲蓄,利息檢查和現金預付款,輕鬆預算和支出跟蹤,賬單談判和訂閱管理以及個性化建議。

GRAD信貸允許沒有信用或稀釋信用文件的消費者使用其現有訂閱帳戶免費建立或建立信貸,例如迪士尼Plys,Netflix,Spotify等。

為您的團隊找到正確的解決方案

CB I188bet游戏nsights技術市場情報平台分析了數百萬個有關供應商,產品,合作夥伴關係和專利的數據點,以幫助您的團隊找到他們的下一個技術解決方案。