CrowdStreet

Founded Year

2014Stage

Debt - II | AliveTotal Raised

$67.43MLast Raised

$43M | 7 mos agoAbout CrowdStreet

CrowdStreet offers an online, commercial real estate investment marketplace. The company's solutions allow real estate developers and operators to accelerate their fundraising processes while achieving enhanced visibility and control over all aspects of investor relations and life-cycle management. The company was founded in 2014 and is based in Austin, Texas.

Missing:CrowdStreet'sProduct Demo & Case Studies

Promote your product offering to tech buyers.

Reach 1000s of buyers who use CB Insights to identify vendors, demo products, and make purchasing decisions.

Missing:CrowdStreet'sProduct & Differentiators

Don’t let your products get skipped. Buyers use our vendor rankings to shortlist companies and drive requests for proposals (RFPs).

Research containing CrowdStreet

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned CrowdStreet in4 CB Insights research briefs, most recently onJul 11, 2022.

Expert Collections containing CrowdStreet

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

CrowdStreet is included in3 Expert Collections,includingReal Estate Tech.

Real Estate Tech

2,457 items

Startups in the space cover the residential and commercial real estate space with a focus on consumers. Categories include buying, selling and investing in real estate (iBuyers, marketplaces, investment/crowdfunding platforms), and also tenant experience, property management, et

Wealth Tech

2,015 items

A category of financial technology that is digitizing & streamlining the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Fintech

7,974 items

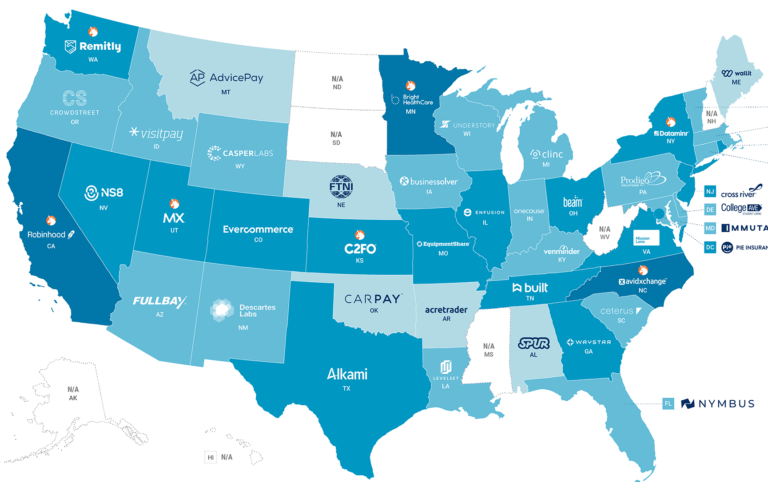

US-based companies

LatestCrowdStreetNews

Apr 18, 2023

CrowdStreet Advisors has announced the launch of CrowdStreet REIT I (or C-REIT) in partnership with iCapital. CrowdStreet Advisors is a wholly-owned subsidiary of CrowdStreet and a federally registered investment adviser. CrowdStreet Advisors provides investment advisory services to privately managed accounts and private funds but does... Read More

CrowdStreetFrequently Asked Questions (FAQ)

When was CrowdStreet founded?

CrowdStreet was founded in 2014.

Where is CrowdStreet's headquarters?

CrowdStreet's headquarters is located at 98 San Jacinto Blvd, Austin.

What is CrowdStreet's latest funding round?

CrowdStreet's latest funding round is Debt - II.

How much did CrowdStreet raise?

CrowdStreet raised a total of $67.43M.

Who are the investors of CrowdStreet?

Investors of CrowdStreet include Seven Peaks Ventures, Green Visor Capital, Rally Ventures, Grotech Ventures, TIAA and 7 more.

Who are CrowdStreet's competitors?

Competitors of CrowdStreet include YieldStreet, Verivest, Roofstock, LEX, AKRU and 7 more.

Compare CrowdStreet to Competitors

Fundrise is an online investment management platform for commercial real estate. Fundrise and its affiliate, Popularise, a real estate crowdsourcing website, continue to transform traditional development by giving community members the power to participate and invest in local real estate.

Realty Mogul is crowdfunding for real estate, a marketplace for accredited investors to pool money online and buy shares of real property such as office buildings, apartment buildings and retail centers. Realty Mogul provides investors with tools to browse investments, conduct due diligence, invest online and track the performance of their investments 24/7 through an online investor dashboard.

Cadre operates a data-centric investing platform that uses predictive models and workflow tools to reengineer the investment experience. It offers commercial real estate investing for individuals, advisors, and institutions. The company was founded in 2014 and is based in New York, New York.

YieldStreet aims to change the way wealth is created by providing access to asset-based investments historically unavailable to most investors. YieldStreet allows users to participate in investment opportunities with low stock market correlation and target yields of 8-20%, across litigation finance, real estate and other alternative asset classes. YieldStreet was founded in 2015 and is based in New York, New York.

PeerStreet is an investment platform focused on democratizing access to real estate debt. The company provides investments in short term, real estate backed loans. PeerStreet allows investors to diversify their capital in an asset class that has been traditionally difficult to access. Loans are sourced and curated from vetted private lenders throughout the United States who have real estate knowledge and borrower relationships. The model allows for more borrowers to access capital and improve their local communities, one house at a time.

LEX is a commercial real estate securities marketplace. LEX Markets lets users access institutional-quality commercial real estate previously unavailable to retail investors.

Discover the right solution for your team

The CB Insights tech market intelligence platform analyzes millions of data points on vendors, products, partnerships, and patents to help your team find their next technology solution.