Superscript

Founded Year

2014Stage

Series B | AliveTotal Raised

$82.35MLast Raised

$54.93M | 4 mos agoAbout Superscript

上標提供商業保險服務。The company offers general, management, and professional insurance coverage. It offers insurance products such as public liability insurance, business interruption insurance, cyber insurance, healthcare professional insurance, and more. It was founded in 2014 and is based in London, United Kingdom.

Superscript's Product Videos

Compete withSuperscript?

Ensure that your company and products are accurately represented on our platform.

Superscript's Products & Differentiators

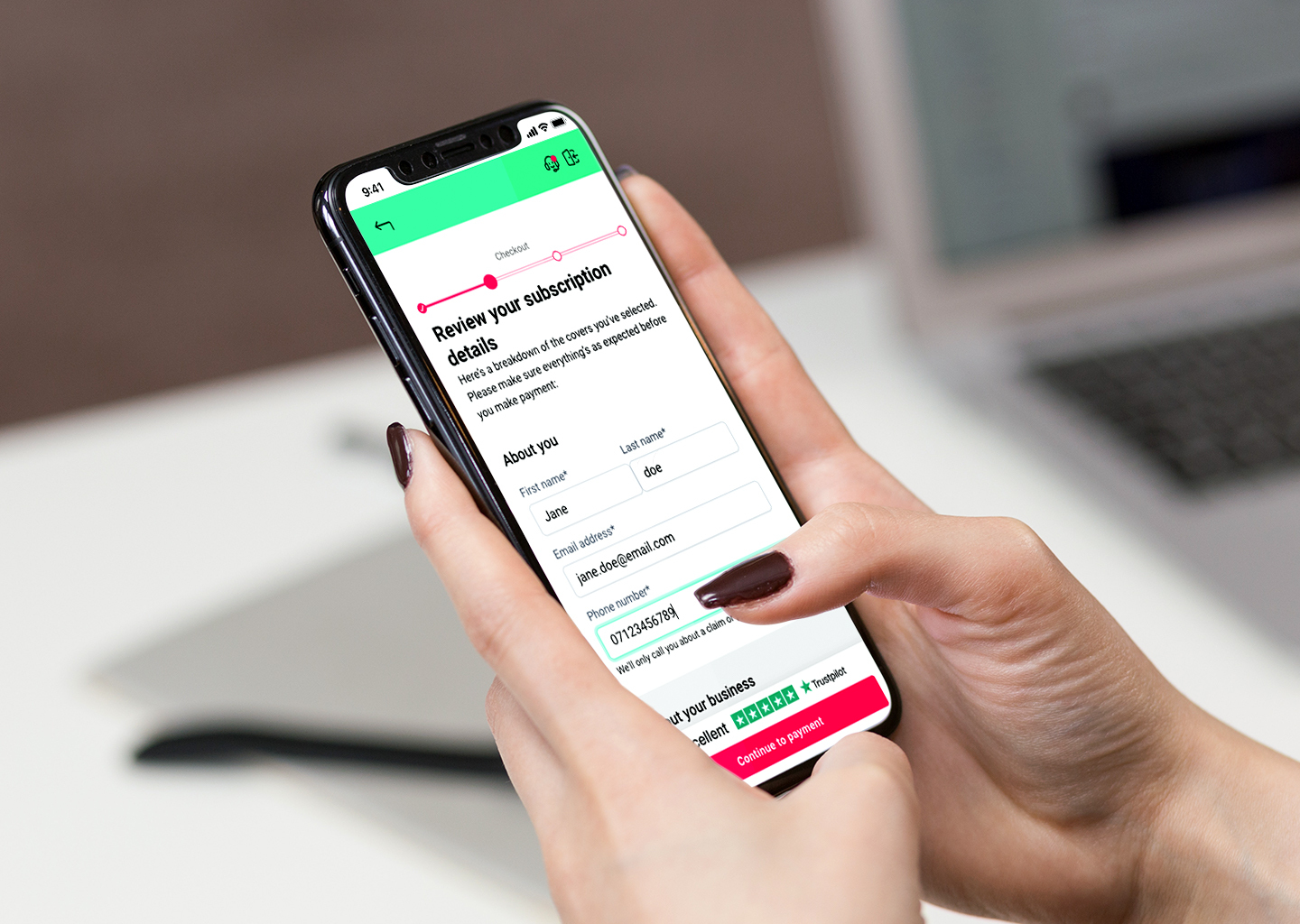

Online (self-serve and assisted)

A self-serve online quote journey for small businesses with standard insurance requirements. Customers can get a quote for bespoke, customisable, subscription-based cover in 4 minutes, and covered in under 10.

Research containing Superscript

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Superscript in2 CB Insights research briefs, most recently onJun 28, 2022.

Expert Collections containing Superscript

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

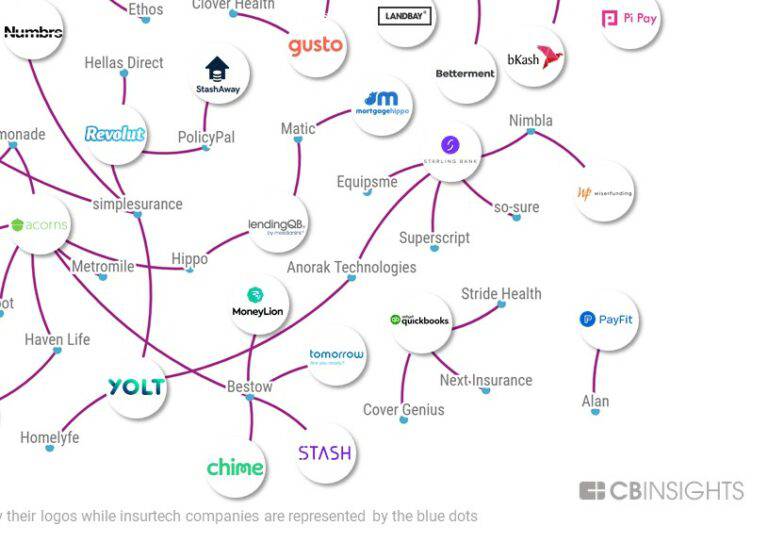

Superscript is included in4 Expert Collections,includingSMB Fintech.

SMB Fintech

1,230 items

Insurtech

4,161 items

Companies and startups that use of technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech 250

250 items

250 of the top fintech companies transforming financial services

Fintech

5,143 items

Track and capture company information and workflow.

LatestSuperscriptNews

Apr 28, 2023

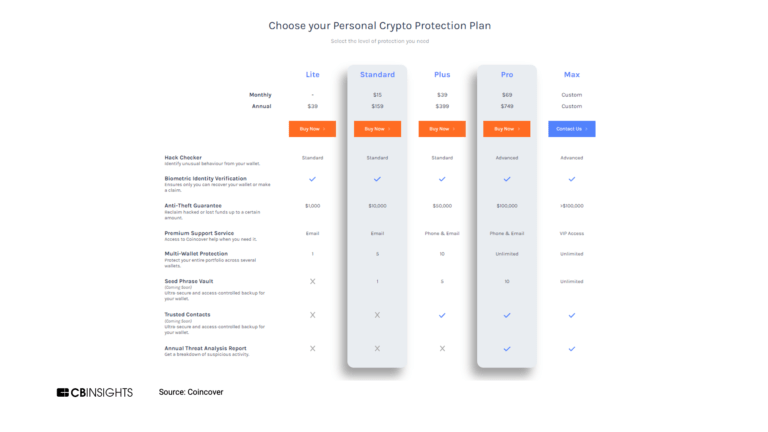

CryptoCFOs , the premier tax and accounting community for finance professionals in the crypto industry, is excited to announce its strategic partnership with Superscript , a Lloyd’s of London insurance broker with world-leading expertise in crypto and blockchain businesses. The collaboration aims to provide a comprehensive support system, community, and education platform for CPAs, finance professionals, tax experts, and others using Superscript as their insurance broker. As part of the partnership, Superscript will contribute to the creation of content and courses focused on Web3 Insurance, enhancing the educational offerings available to CryptoCFOs’ members. Superscript will also become a trusted partner within the CryptoCFOs ecosystem, continuing to provide valuable insurance solutions tailored to the unique needs of businesses operating in the crypto and blockchain space. “We’re thrilled to partner with Superscript, a leader in the insurance space for crypto and blockchain businesses. Our collaboration will bring unparalleled value to our members, equipping them with the knowledge and resources they need to thrive in the Web3 revolution,” said Taylor Zork, CEO, CryptoCFOs. Superscript’s insurance expertise spans across multiple segments of the crypto ecosystem, including custodians, miners, validators, NFT and DeFi platforms, financial services, exchanges, and blockchain infrastructure. The company offers bespoke insurance coverage for directors and officers (D&O), key persons, technology errors and omissions and cyber, professional technology liability, financial institutions professional indemnity (FIPI), custodianship, property, crime, and slashing. “The partnership with CryptoCFOs aligns perfectly with our mission to enable crypto businesses to grow and scale, by providing them with the right insurance coverage that reflects their distinct needs. We’re excited to contribute our expertise to the CryptoCFOs community and support the growth and success of finance professionals in this dynamic industry,” said Ben Davis, Team Leader – Digital Assets CryptoCFOs has established itself as the leading community for accountants, tax preparers, and finance professionals looking to grow their practice, enter, or establish themselves in the crypto industry. The partnership with Superscript further solidifies CryptoCFOs’ commitment to providing its members with the tools, knowledge, and support they need to thrive in the Web3 era. People In This Post Insurtech Funding Fintech TV Fintech TV Fintech TV

SuperscriptFrequently Asked Questions (FAQ)

When was Superscript founded?

Superscript was founded in 2014.

Where is Superscript's headquarters?

Superscript's headquarters is located at 180 Borough High Street, London.

What is Superscript's latest funding round?

Superscript's latest funding round is Series B.

How much did Superscript raise?

Superscript raised a total of $82.35M.

Who are the investors of Superscript?

Investors of Superscript include Concentric, BGL Group, The Hartford, Base Capital, Lloyd's Lab and 9 more.

Who are Superscript's competitors?

Competitors of Superscript include Next Insurance and 7 more.

What products does Superscript offer?

Superscript's products include Online (self-serve and assisted) and 1 more.

Compare Superscript to Competitors

派工人com保險運營平台pensation insurance. Its platform matches price with risk across a broad spectrum of small business types, which allows Pie to offer affordable insurance to small business owners. The firm was founded in 2017 and is based in Washington, District of Columbia.

Cerity is an Austin, TX-based insurance tech startup that is developing software that uses artificial intelligence to match worker's compensation policies to small businesses that otherwise wouldn't get them.

Mylo offers small businesses and individuals digital access to insurance services and coverage. It develops proprietary technology that makes precise coverage recommendations for every user. It identifies the best carrier match and quotes the right policy at the best value. Mylo's insurtech platform can be integrated by companies in different industries. The company was founded in 2017 and is based in Kansas City, Missouri.

Amwins (American Wholesale Insurance Group) is a wholesale distributor of specialty insurance products and services with expertise across a diversified mix of property, casualty, and group benefits products. Amwins also offers value-added services to support some of these products, including product development, underwriting, premium and claims administration, and actuarial services. Amwins operates in four divisions: Brokerage, Underwriting, Group Benefits, and International.

Assureful is an insurance company that provides a range of insurance products and services for e-commerce businesses. The company provides smart insurance for private label brands, retail arbitrage, resellers, wholesalers, aggregators, and more. It was founded in 2020 and is based in Spokane, Washington.

Hourly offers a platform enabling small business owners to pay, manage, and protect their hourly workers. It connects workers' compensation insurance, payrolls, and time tracking in real time. The company was founded in 2018 and is based in Palo Alto, California.

Discover the right solution for your team

The CB Insights tech market intelligence platform analyzes millions of data points on vendors, products, partnerships, and patents to help your team find their next technology solution.