第一大道

成立一年

2020階段

一個係列 |活著總了

20美元最後提出了

15美元 1年前與第一大道?

確保您的公司和產品在我們的平台上得到準確的展示。

有關第一大道的研究

從CB Insights情報部門獲得數據驅動的專家分析。188bet游戏

188bet游戏CB Insights情報分析師提到了第一大道2 188bet游戏CB Insights研究簡報,最近在2021年6月15日.

2021年6月15日

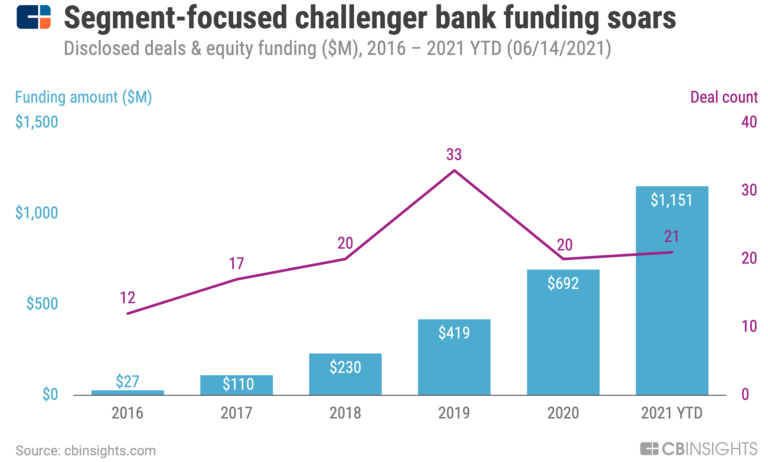

針對特定人群的挑戰者銀行正在獲得數百萬客戶。以下是現有企業應該關注的原因

2021年4月29日

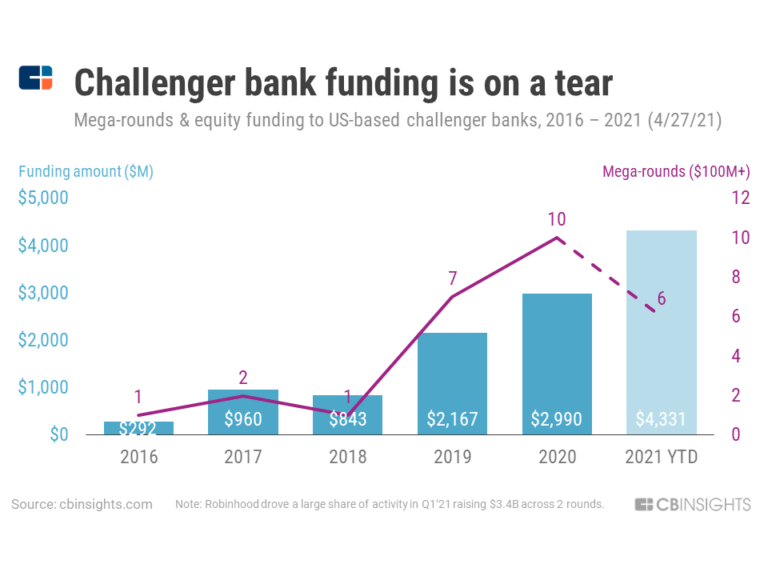

挑戰者銀行的融資正在飆升。接下來會發生什麼專家收藏包括第一大道

專家收藏是由分析師策劃的列表,突出了你在最重要的技術領域需要了解的公司。

包括第一大道2專家收藏,包括銀行.

銀行

1023件

Fintech

7745件

總部位於美國的公司

最新的第一大道新聞

2021年10月29日

“這是一家銀行。我們在這裏是為了賦予美國黑人權力,但你為什麼認為這意味著我們在幫助窮人?”近年來,隨著越來越多的數字銀行初創公司爭奪曆史上在傳統機構開戶或被完全排除在銀行係統之外的消費者,針對服務不足社區的新銀行出現了。但隨著這些初創公司尋求增加投資,一些人說他們經常遇到的一個問題是財富偏見。“當我們出去推銷時,每次我們說,‘這是美國黑人的一家新銀行’,人們就開始和我談論我應該去找的不同慈善基金會要錢,”第一大道首席運營官阿斯亞·布拉德利說,他於2020年8月與首席執行官唐納德·霍金斯共同創立了這家新銀行。“你們為什麼都認為這是慈善事業?”這是一家銀行。我們在這裏是為了賦予美國黑人權力,但你為什麼認為這意味著我們在幫助窮人?”布拉德利本周在Money20/20會議的一個小組討論會上發言說,當一些投資者考慮女性的需求時,財富偏見也存在。她說,有一種假設認為女性是“厭惡風險的”,“不知道如何投資”。 "So you're going to have to educate them, right? Your products can be all about education only, because women don't have money," said Bradley, highlighting some of the feedback she said she often receives from investors. "Wealth bias is this assumption that whoever we're helping is going to be poor," she said. Bradley noted the 2019 New York Times report detailing racial discrimination involving former NFL player Jimmy Kennedy, who was denied private wealth client status by JPMorgan Chase, despite moving $800,000 to the bank. Kennedy, who is Black, had been promised "private client" status, reserved for accounts with over $250,000, but was denied because of the color of his skin, according to audio recordings accessed by the Times. The incident garnered national attention and demands from lawmakers that the bank provide information regarding the allegations. In a 12-page letter to lawmakers, the bank admitted to several shortcomings and told employees in an internal memo it was creating a team to spur improvements on discrimination. "With wealth bias, it doesn't even matter how much money you have as a Black person, you're still going to deal with racist people," Bradley said. First Boulevard, which raised $5 million in seed funding in March, has a waitlist of 100,000, according to TechCrunch . Building generational wealth Like First Boulevard, Atlanta-based digital bank Greenwood shares a mission of wanting to help underserved communities build generational wealth. Rapper and activist Michael "Killer Mike" Render, one of the founders of the startup that aims to serve Black and Latinx communities, said it’s not just those at the bottom of the economic ladder who are facing discrimination in financial services. "I'm a businessman. I had millions of dollars in one of the largest banks and when I went to them to say, ‘I want to buy a piece of real estate, I've got great credit,’ they were like, ‘We can't give you the loan, Michael,’" Render told Money 20/20 conference attendees at a separate panel discussion. "I was like, ‘Well, I'm taking my money out of your f****** bank.’" Render said the bank, whose response was to steer him toward placing his funds into an investment account, eventually gave him the loan. "Although I found it disturbing and was a little insulted by it, I understood how hard it must be for working-class Michael to ask for a car loan," Render said. "I understood how difficult it must be to be refused for a home loan when you pay rent faithfully for five, 10 or 15 years sometimes. You finally get in a position to do it, and then your bank tells you no." During the discussion, Render shared advice on how audience members can support the Black community with their wallets, reiterating Bradley’s sentiment that the startup isn’t looking for handouts. "I don't need charity. I need you to actively put your dollar in my community so that we can circulate it and make the greater economy better," he said, encouraging attendees to commit to shop at a Black-owned business at least once a week. "If the Black community is doing better, the whole community is doing better." Greenwood was formed in October 2020 by Render, civil rights leader Andrew Young and Atlanta-based entrepreneur and founder of Bounce TV Ryan Glover. The platform, which is in beta with 200 users, has more than 600,000 on its waitlist, the neobank said. Follow Anna Hrushka on Twitter

第一大道常見問題

第一大道是什麼時候建立的?

第一大道成立於2020年。

第一大道的總部在哪裏?

第一大道的總部位於w110街5440號,肖尼Mission。

第一大道的最新一輪融資是什麼?

First Boulevard的最新一輪融資是A輪。

第一大道籌集了多少錢?

第一大道總共籌集了2000萬美元。

第一大道的投資者是誰?

First Boulevard的投資者包括Anthemis、巴克萊銀行(Barclays Bank)、Gabrielle Union、John Buttrick和Jamere Jackson。

第一大道的競爭對手是誰?

第一大道的競爭對手包括Chime和另外4家。

比較第一大道和競爭對手

Current提供協同銀行解決方案。當前的個人支票讓個人更快地支付直接存款,最多提前兩天和即時汽油持有信用。青少年銀行是一款智能借記卡和應用程序,父母為他們的孩子提供更好的金融教育和獨立性。

Brigit是一家對社會負責任的財務健康公司,旨在通過負責任的融資和個人理財教育為個人提供財務安全網。

移動資本金融(MoCaFi)是一個移動優先平台,提供金融服務產品。MoCaFi提供了一個以用戶為中心的平台,為每個人創建一個金融社交圖。這張圖提供了一個基於用戶特定年齡和階段應該使用的金融產品和服務的快照。這成為他們可以遵循的路線圖,過上健康、富有成效的財務生活。如果用戶需要額外的指導,MoCaFi將向他們推薦一組高質量的產品,以滿足他們的需求,並幫助他們實現路線圖的目標。

MOMENTO為美國沒有銀行賬戶或服務不足的人群開發了一款數字銀行應用程序。該公司的應用程序提供免費彙款作為獲取直接存款用戶的門戶,並特別關注定期向生活在國外的親人彙款的移民人群。它成立於2020年,總部設在紐約。

Revolut提供個人資金雲服務,將隱藏的銀行費用降至零。它允許用戶以完美的銀行間利率兌換貨幣,通過社交網絡彙款,並在任何接受萬事達卡的地方使用多幣種卡消費。所有這些都是在一個移動應用程序中通過觸摸一個按鈕來完成的。該公司的目標是完全消除所有隱藏的銀行成本。

Monzo是一家數字銀行,用戶可以通過手機跟蹤支出、分攤賬單、彙款等。

為您的團隊發現正確的解決方案

CB I188bet游戏nsights技術市場情報平台分析供應商、產品、合作夥伴和專利的數百萬個數據點,幫助您的團隊找到他們的下一個技術解決方案。