葡萄幹

成立一年

2012年階段

E係列 |活著總了

272.36美元最後提出了

65.35美元 | 4 mos前馬賽克的分數

馬賽克評分是一種算法,私營企業的整體財務狀況和市場潛力。

+ 120點在過去的30天

與葡萄幹嗎?

確保你的公司和產品準確地代表在我們的平台上。

葡萄幹的產品和優勢

儲蓄市場

葡萄幹、WeltSparen Savedo、Zinspilot SaveBetter葡萄幹DS平台的終端客戶,可以通過簡單的標識和注冊過程,具有廣泛的葡萄幹夥伴銀行存款產品(從不同的銀行、不同的產品,可以在每個市場)。

研究含有葡萄幹

獲得CB的數據驅動的專家分析見解信息部。188bet游戏

188bet游戏情報分析家提到葡萄幹CB見解2 188bet游戏CB見解研究簡報,最近在2021年1月25日,。

2021年1月25日,

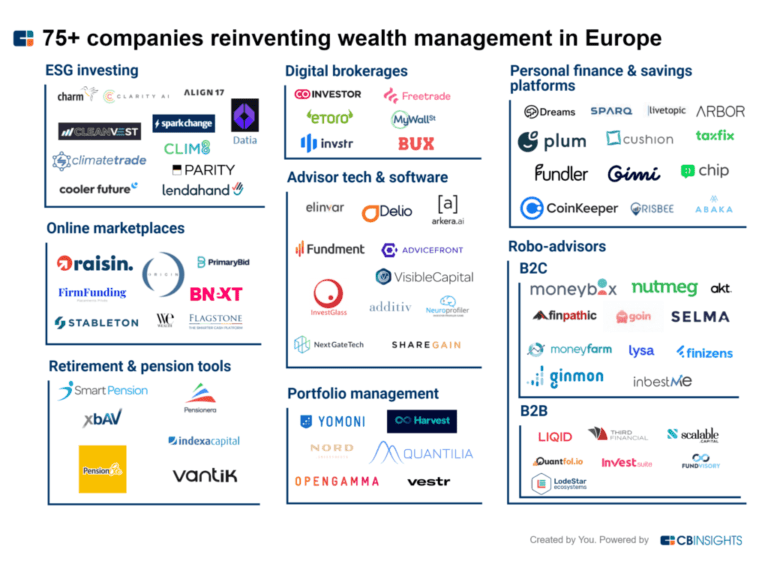

75 +公司重塑歐洲財富管理

2020年12月15日

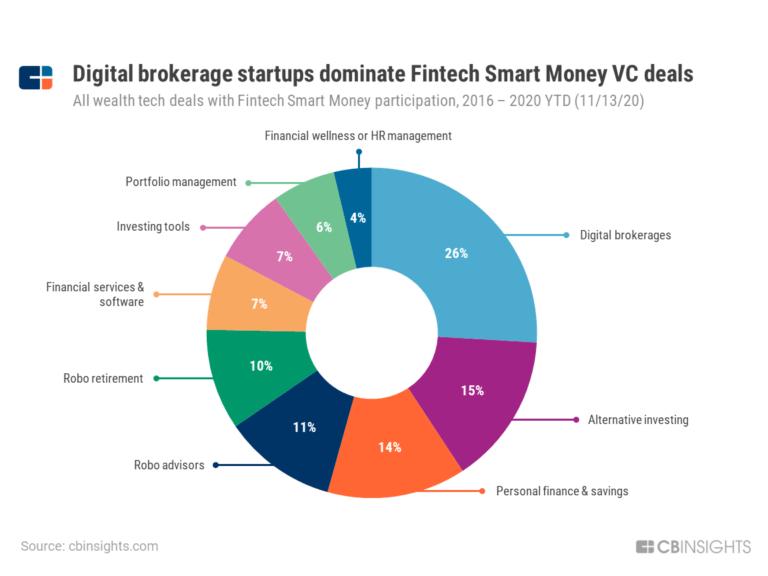

Fintech聰明錢投在哪裏把賭注放在財富科技嗎專家集合包含葡萄幹

專家集合是analyst-curated列表,突出了公司你需要知道的最重要的技術空間。

葡萄幹是包含在3專家集合,包括財富科技。

財富科技

2045件

一個類別的金融技術數字化和簡化的財富管理。包括:公司提供的工具提供商主動和被動散戶投資者的財富管理和顧問。

Fintech 250

748件

Fintech

12354件

不包括美國公司

最新的葡萄幹新聞

2023年3月24日,

葡萄幹fintech公司關閉了新一輪融資。大約€6000萬係列E輪從兩個投資者,根據總部位於柏林的公司。盎格魯-撒克遜私人股本專家M&G催化劑把大部份的總和作為一種新的投資者。美國投資銀行高盛(Goldman Sachs)前股東fintech再次參與。閱讀更多關於葡萄幹,一天中最重要的金融新聞Born2Invest移動應用。葡萄幹不想評論公司的估值由Grunderszene然而,當被問及“有點驕傲在當前的市場環境中,我們可以發現這麼多:我們的獨角獸狀態與當前Upround已經確認,“葡萄幹創始人弗蘭克Freund宣布通過電子郵件。因此,fintech公司投資者現在價值十億美元。可以肯定的是,葡萄幹在最新交易作為一個獨角獸與漢堡的競爭對手合並後存款方案去年的2021,然而,地位似乎暫時消失後再葡萄幹投資者Kinnevik重視圖書的fintech他們“僅僅”€8.95億。Finanz-Szene首次報道。當時行業門戶的貶值與疲軟的增長數據。根據自己的信息,然而,葡萄幹的業務發展良好。 The fintech company has been profitable for half a year and has passed the mark of one million customers, it said. Raisin is a platform where private investors can compare various offers for overnight or fixed-term deposit accounts and invest their money abroad, where higher interest rates are often offered than in Germany. In addition, Raisin offers savings plans for index funds (ETFs) and investments in cryptocurrencies. Criticism of lure offers from competitors Freund, the founder of Raisin, does not see the fact that fintech companies such as Trade Republic and Scalable Capital are now advertising high-interest rates alongside many German banks as a problem. Many of these apparently attractive interest rates have restrictions on closer inspection. “In some cases, they only apply to new customers, only up to a certain investment amount or only over a few months. Often additional fees are then due, for example in the form of a paid premium membership. This then often eats up the attractive interest rates,” Freund argued. Such provisions are not found in Raisin’s overnight and fixed-term deposit accounts. In addition, his company is growing to a large extent in other European countries, in Great Britain and the USA, for example. With the money from the new funding round, the fintech company now wants to develop new features that will “further lower the barriers to saving and investing with Raisin.” It also aims to further accelerate growth in expanding markets such as the U.S., where Raisin launched in 2020 and manages well over a billion euros in assets for customers. In total, the Berlin-based unicorn manages €38 billion. __ DISCLAIMER: This article was written by a third party contributor and does not reflect the opinion of Born2Invest, its management, staff or its associates. Please review our disclaimer for more information. This article may include forward-looking statements. These forward-looking statements generally are identified by the words “believe,” “project,” “estimate,” “become,” “plan,” “will,” and similar expressions. These forward-looking statements involve known and unknown risks as well as uncertainties, including those discussed in the following cautionary statements and elsewhere in this article and on this site. Although the Company may believe that its expectations are based on reasonable assumptions, the actual results that the Company may achieve may differ materially from any forward-looking statements, which reflect the opinions of the management of the Company only as of the date hereof. Additionally, please make sure to read these important disclosures . First published in GRÜNDERSZENE , a third-party contributor translated and adapted the article from the original. In case of discrepancy, the original will prevail. Although we made reasonable efforts to provide accurate translations, some parts may be incorrect. Born2Invest assumes no responsibility for errors, omissions or ambiguities in the translations provided on this website. Any person or entity relying on translated content does so at their own risk. Born2Invest is not responsible for losses caused by such reliance on the accuracy or reliability of translated information. If you wish to report an error or inaccuracy in the translation, we encourage you to contact us.

葡萄幹常見問題(FAQ)

葡萄幹是何時成立的?

葡萄幹成立於2012年。

葡萄幹的總部在哪裏?

葡萄幹的總部位於Schlesische街,33/34,柏林。

葡萄幹的最新一輪融資是什麼?

葡萄幹的最新一輪融資係列E。

葡萄幹籌集了多少錢?

葡萄幹籌集了總計272.36美元。

葡萄幹的投資者是誰?

葡萄幹的投資者包括M&G投資,高盛(Goldman Sachs)、葡萄幹DS, GS增長,橙色數字企業和17。

葡萄幹的競爭對手是誰?

葡萄幹的競爭對手包括FutureAdvisor,人類利益,Blooom ForUsAll、改良和8。

葡萄幹提供什麼產品?

葡萄幹的產品包括儲蓄市場和3。

把葡萄幹和競爭對手

SigFig運作作為一個金融科技公司。它專門從事財富管理、零售銀行、退休規劃、稅收籌劃等。公司成立於2006年,總部設在舊金山,加利福尼亞。

改善是一個在線投資平台。投資平台提供解決方案,如加密、自動化投資,財務計劃,退休計劃,等等。它成立於2008年,總部設在紐約,紐約。

ForUsAll提供一個平台讓雇主提供一個現代的401 (k)計劃向員工提供cryptocurrency,金融健康的好處,和低費用。平台提供的功能,如直接投資一係列cryptocurrency令牌,自動化的計劃管理、auto-reconciling工資集成、跟蹤和入學資格的員工,和可操作的金融的見解。公司成立於2012年,總部設在舊金山,加利福尼亞。

Wacai fin-tech公司運營。開發一個在線的個人財務管理平台,為用戶提供財富管理服務和信貸解決方案。公司成立於2009年,總部位於杭州,中國。

Wealthsimple是一個技術驅動的投資經理,結合robo-advisor平台提供生活顧問。公司成立於2014年,總部設在多倫多,安大略省。

有人情味的中小型企業提供退休福利使員工更安全的金融期貨。自動投資組合再平衡其內置的投資教育和幫助員工保存在簡單的步驟。它還提供了個性化的投資建議。公司原名Captain401。它成立於2015年,總部設在舊金山,加利福尼亞。

發現正確的解決方案為您的團隊

CB見解188bet游戏科技市場情報平台分析數百萬數據點在供應商、產品、合作關係,專利來幫助您的團隊發現他們的下一個技術解決方案。