Investments

240Portfolio Exits

44Funds

8About Creandum

Creandum is a Nordic venture capital firm investing in early-stage technology companies. The firm has 120 million Euros under management. All investment professionals at Creandum has started companies or been part of successful startups.

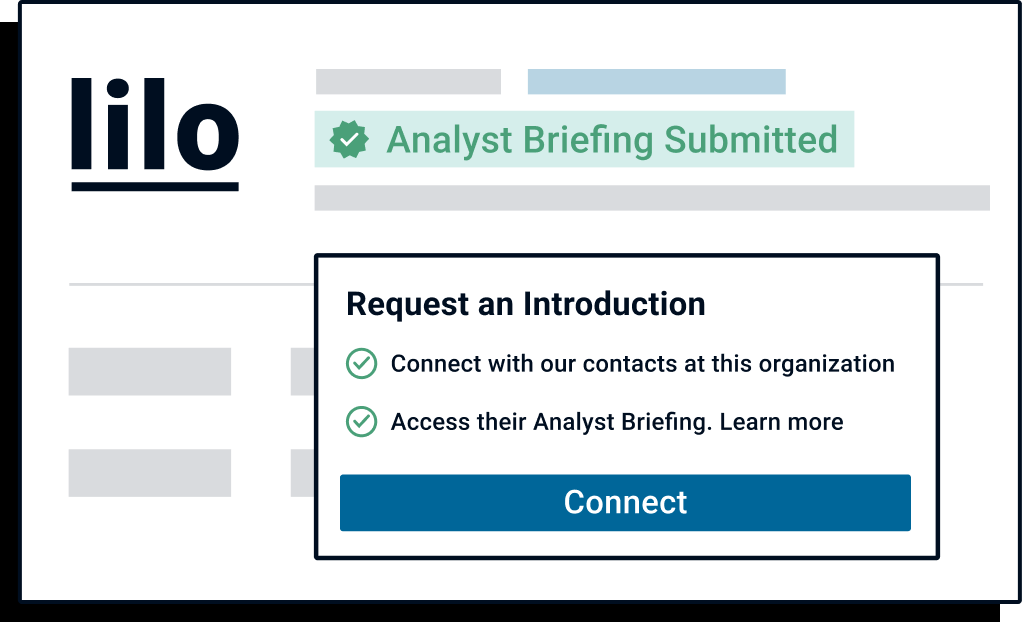

Want to inform investors similar toCreandumabout your company?

Submit your Analyst Briefing to get in front of investors, customers, and partners on CB Insights’ platform.

Expert Collections containing Creandum

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find Creandum in2 Expert Collections,includingStore management tech (In-store retail tech).

Store management tech (In-store retail tech)

55 items

Startups aiming work with retailers to improve brick-and-mortar retail operations.

Fitness Tech

227 items

We define fitness tech as companies leveraging software and technology to augment approaches to developing or maintaining physical fitness. Companies in this category develop tools and services including workout apps, wearables, and connected fitness equipment.

Research containing Creandum

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Creandum in1 CB Insights research brief, most recently onDec 9, 2021.

LatestCreandumNews

Mar 24, 2023

Vue店麵,舊金山,CA和華沙,Poland-based Frontend as a Service company delivering custom storefronts, raised $20M in Equity funding. The round was led by Felix Capital, with participation from Philippe Corrot, Nagi Letaifa, Creandum, Earlybird and SquareOne. The company intends to use the funds to continue on its growth trajectory, scale up the teams and product, and expand internationally. Led by Patrick Friday, co-founder and CEO, Tim Drijvers, CTO, Gordana Vuckovic, CRO, Bart Roszkowski, co-founder and COO and Filip Rakowski, co-founder and CDXO, Vue Storefront is a Frontend as a Service platform that delivers custom storefronts. In conjunction with the funding, Julien Codorniou, who joined Felix Capital last year from Facebook, will join Vue Storefront’s board of directors.Vue Storefront is now being used to power the online stores of over 2,200 retailers and merchants across the globe, including Orgill, Tally Weijl and Zenni. The company scaled globally with over 100 people in 10 countries. In the last 12 months, Vue Storefront has added customers like Berlin Brand Group, Zenith Watches and Zadig & Voltaire with more than 50% of its pipeline coming from the US enterprise market. FinSMEs

Creandum Investments

240 Investments

Creandum has made240 investments.Their latest investment was inVue Storefrontas part of theirSeries A - IIonMarch 3, 2023.

Creandum Investments Activity

Date |

Round |

Company |

Amount |

New? |

Co-Investors |

Sources |

|---|---|---|---|---|---|---|

|

3/23/2023 |

Series A - II |

Vue Storefront |

$20M |

No |

4 |

|

|

3/1/2023 |

Series A - II |

CAST AI |

$20.14M |

Yes |

7 |

|

|

11/1/2022 |

Series A |

Enode |

$15M |

Yes |

3 |

|

|

10/18/2022 |

Pre-Seed |

|||||

|

10/11/2022 |

Series C |

Date |

3/23/2023 |

3/1/2023 |

11/1/2022 |

10/18/2022 |

10/11/2022 |

|---|---|---|---|---|---|

Round |

Series A - II |

Series A - II |

Series A |

Pre-Seed |

Series C |

Company |

Vue Storefront |

CAST AI |

Enode |

||

Amount |

$20M |

$20.14M |

$15M |

||

New? |

No |

Yes |

Yes |

||

Co-Investors |

|||||

Sources |

4 |

7 |

3 |

CreandumPortfolio Exits

44 Portfolio Exits

Creandumhas44portfolioexits. Their latest portfolio exit wasMonta onMarch 03, 2023.

Date |

Exit |

Companies |

Valuation

Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model.

|

Acquirer |

Sources |

|---|---|---|---|---|---|

|

3/3/2023 |

Acquired |

2 |

|||

|

3/23/2022 |

Acquired |

2 |

|||

|

3/2/2022 |

Acquired |

2 |

|||

Date |

3/3/2023 |

3/23/2022 |

3/2/2022 |

||

|---|---|---|---|---|---|

Exit |

Acquired |

Acquired |

Acquired |

||

Companies |

|||||

Valuation |

|||||

Acquirer |

|||||

Sources |

2 |

2 |

2 |

CreandumFund History

8 Fund Histories

Creandumhas8 funds, includingCreandum VI.

Closing Date |

Fund |

Fund Type |

Status |

Amount |

Sources |

|---|---|---|---|---|---|

|

3/1/2022 |

Creandum VI |

|

|

$500M |

3 |

|

6/24/2019 |

Creandum V |

||||

|

2/1/2016 |

Creandum IV |

||||

|

5/7/2013 |

Creandum IIII |

||||

|

2/7/2007 |

Creandum II |

Closing Date |

3/1/2022 |

6/24/2019 |

2/1/2016 |

5/7/2013 |

2/7/2007 |

|---|---|---|---|---|---|

Fund |

Creandum VI |

Creandum V |

Creandum IV |

Creandum IIII |

Creandum II |

Fund Type |

|

||||

Status |

|

||||

Amount |

$500M |

||||

Sources |

3 |

CreandumTeam

6 Team Members

Creandumhas6 team members,including,.

Name |

Work History |

Title |

Status |

|---|---|---|---|

|

Stefan Lindeberg |

Nordic Game Ventures,ZeroPoint Technologies,Conor Venture Partners,Microsoft,Cisco,Network Systems,andIBM |

Founder |

Current |

Name |

Stefan Lindeberg |

||||

|---|---|---|---|---|---|

Work History |

Nordic Game Ventures,ZeroPoint Technologies,Conor Venture Partners,Microsoft,Cisco,Network Systems,andIBM |

||||

Title |

Founder |

||||

Status |

Current |

Discover the right solution for your team

The CB Insights tech market intelligence platform analyzes millions of data points on vendors, products, partnerships, and patents to help your team find their next technology solution.