合作夥伴和客戶

9服務提供商

1

想告知投資者類似公會抵押貸款關於你的公司嗎?

提交你的分析師簡報在投資者麵前,CB Insights的平台上的客戶和合作夥伴。188bet游戏

研究包含公會抵押貸款

獲得CB的數據驅動的專家分析見解信息部。188bet游戏

188bet游戏CB見解情報分析家提到公會抵押貸款1 188bet游戏CB見解研究短暫,最近在2021年3月22日。

2021年3月22日

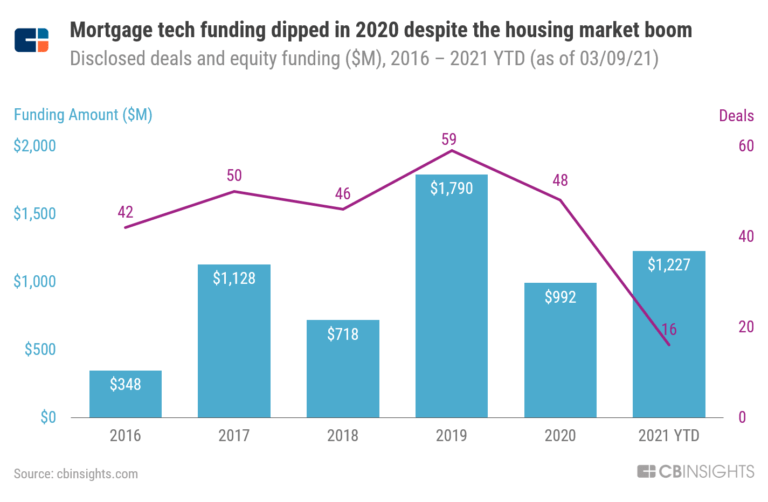

抵押貸款技術資金籃板後緩慢的2020最新的公會抵押貸款新聞

2023年8月4日

3分鍾閱讀聖地亞哥巨頭公會抵押貸款在第二季度恢複盈利,這在一定程度上要歸功於成功的集成眾多公司第一季度的銀行收購了。抵押貸款商店激光專注於擴大市場份額,公司高管指出他們在尋找其他公司購買在不久的將來。公會的淨收入為3690萬美元,高於前一個季度淨虧損3720萬美元。銀行的淨營收增長逾一倍,從1.039億美元增加到2.368億美元的貸款在2023年第一季度的報告。獲得銷售利潤率在2023年第二季度發放310個基點。公會的內部發放總額45億美元,高於第一季的27億美元。特裏•施密特公會抵押貸款的新首席執行官表示,第二季度結果的反映公司的推動“進一步規模[其]平台。”"We are achieving this to the successful execution of our organic and external growth strategy," she said during the company's earnings call. "Broader industry challenges persist due to higher interest rates, and limited home inventory, which is putting pressure on production volume and industry margin, however, the Guild brand within the mortgage industry is stronger than it's ever been." Additionally, the lender's portfolio unpaid principal balance grew to $82 billion as of June 30, up 3% compared to $79.9 billion in the first quarter and an 8% increase from $75.9 billion last year. "We retain mortgage servicing rights for 84% of the total loan sold in the second quarter of 2023. This provides both reliable fee income as well as continued interaction with our customers supporting our strong recapture rate," Shmidt said. The company's CEO added that Guild's "strong balance sheet and liquidity position supports ongoing pursuits of additional growth opportunities." "Guild has engaged in several opportunistic acquisitions in the recent years, which has grown our reputation as a valued business partner, and we believe the continued needed origination environment will create additional opportunities for us to add smaller businesses to Guild's platform," she said. In recent months the lender has been on a buying spree, acquiring reverse mortgage lender Cherry Creek Mortgage , Legacy Mortgage and Inlanta Mortgage. It also brought on eight branches from Fairway Independent Mortgage in March, adding to its ballooning headcount of over 4,000 employees. Regarding Cherry Creek, Scmidt noted that within 45 days of acquiring the company it became fully operational and the 500 employees onboarded are "almost going full speed," Schmidt said. "We've gotten better at integrating [new companies that we bring in], we're comfortable continuing to work towards adding more of these types of acquisitions." Despite solid financial results for the second quarter, year-to-date the company reported a net loss of $0.3 million compared to a net income of $266.3 million in 2021. And to no one's surprise total in-house originations of $7.2 billion year-to-date were also significantly lower compared to the $11.8 billion reported in 2021. Guild's second quarter results beat the expectations of some analysts. A report from Wedbush noted that Guild's "gain on sale and servicing revenues were higher than expected, driven by higher than expected volumes." "The company sees additional opportunities to add smaller businesses to the Guild platform, giving muted origination activity, which should help to generate market share gains over time," the report added.

公會按揭合作夥伴和客戶

9個合作夥伴和客戶

公會抵押貸款了9的戰略合作夥伴和客戶。工會最近與抵押貸款西班牙房地產協會專業人士在2022年9月9日。

日期 |

類型 |

業務合作夥伴 |

國家 |

新聞片段 |

來源 |

|---|---|---|---|---|---|

|

9/27/2022 |

合作夥伴 |

美國 |

公會抵押貸款,實施以增長為導向的原始和服務住宅貸款抵押貸款公司自1960年以來,與西班牙房地產協會專業人士,因為它繼續增長戰略和多樣化的社區在美國擴大其影響 |

1 |

|

|

7/13/2022 |

合作夥伴 |

||||

|

4/14/2020 |

許可方 |

||||

|

6/13/2019 |

合作夥伴 |

||||

|

1/9/2019 |

供應商 |

日期 |

9/27/2022 |

7/13/2022 |

4/14/2020 |

6/13/2019 |

1/9/2019 |

|---|---|---|---|---|---|

類型 |

合作夥伴 |

合作夥伴 |

許可方 |

合作夥伴 |

供應商 |

業務合作夥伴 |

|||||

國家 |

美國 |

||||

新聞片段 |

公會抵押貸款,實施以增長為導向的原始和服務住宅貸款抵押貸款公司自1960年以來,與西班牙房地產協會專業人士,因為它繼續增長戰略和多樣化的社區在美國擴大其影響 |

||||

來源 |

1 |

比較公會抵押給競爭對手

更好的房地產抵押貸款抵押貸款提供了一個平台。平台提供了一個數字市場具有競爭力的報價從數組的保險公司無縫購買房屋保險政策和即時訪問房地產經紀人。公司成立於2016年,總部設在紐約,紐約。

LoanSnap發展智能貸款技術,使用人工智能來分析一個人的整個金融圖片並顯示簡單的方法受益於一個更聰明的貸款現在和未來。

運動抵押貸款提供住房的機會和貸款和抵押貸款給客戶。它專門從事抵押貸款和住房貸款業務。公司成立於2008年,總部設在印度的土地,北卡羅萊納。

海軍聯邦信用合作社是一個軍事信用社。公司提供支票和儲蓄、貸款、信用卡和抵押貸款。它成立於1933年,位於·梅裏菲爾德維吉尼亞州。

承認自己是一個在線房屋貸款市場。開發一個軟件即服務(SaaS)的抵押貸款市場和提供禮賓服務來幫助導航家融資旅程的每一步。它成立於2016年,總部設在波士頓,馬薩諸塞州。

直線是一個fintech抵押貸款銀行,為消費者提供了一個平台獲得房屋貸款。平台允許用戶直接鏈接他們的銀行,支付,稅收信息得到準確數據可靠的批準。公司成立於2019年,位於普羅維登斯,羅得島。