投資

1

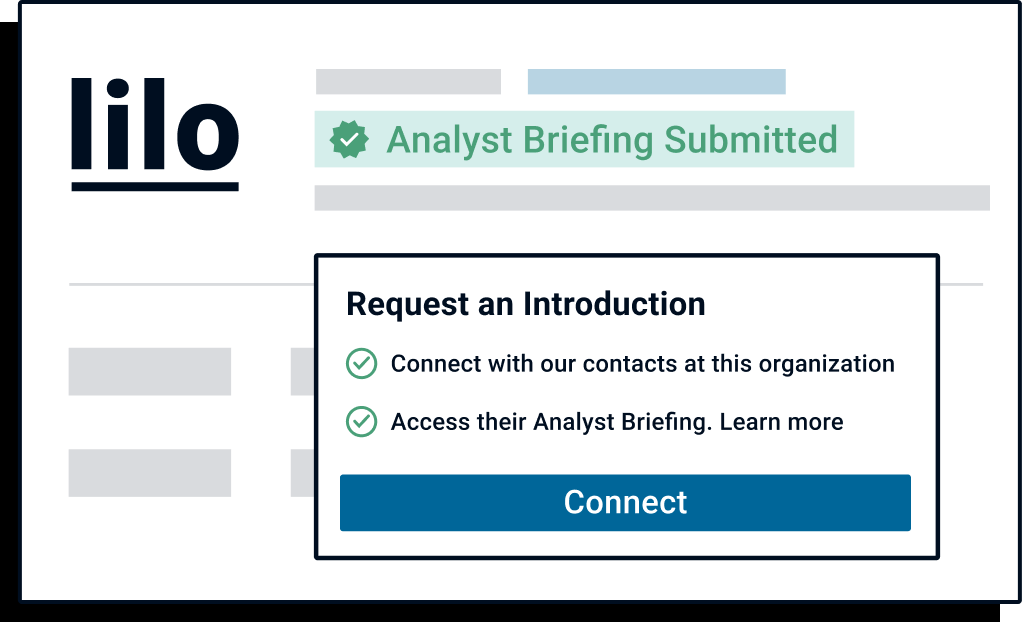

想告知投資者類似勞倫斯Lepard關於你的公司嗎?

提交你的分析師簡報在投資者麵前,CB Insights的平台上的客戶和合作夥伴。188bet游戏

最新的勞倫斯Lepard新聞

2023年3月11日,

排長隊曾被觀察到在波士頓私人銀行服務提供者,最近被矽穀銀行(SVB)。銀行擠兌在波士頓私人銀行嗎?投資經理,根據勞倫斯Lepard波士頓私人目前可能出現銀行擠兌。3月11日,有排長隊,儲戶撤回他們的血汗錢。1930年的陰影。這是我今天早上銀行在韋爾斯利。波士頓私人銀行,最近被矽穀銀行收購。Ruh,盧武鉉。pic.twitter.com/MAD46ozShx——勞倫斯•Lepard”修複,修複世界”(@LawrenceLepard) 3月10日,2023年2021年,波士頓私人被SVB以10億美元收購。SVB也把USDC的崩潰,出具stablecoin圓,其他公司的一個財團,麵臨巨大的壓力。 At the time of writing on March 11, USDC had de-pegged, trading at $0.96 to the USD. SVB is one of six banking partners Circle uses for managing around a quarter of its reserves held in cash. While Circle and USDC continue to operate normally, the position of USDC in crypto and the uncertainty surrounding SVB has caused a ripple effect across the market. Related Reading: USDC Is In Trouble, But It Won’t Go To Zero Like UST Did – Here’s Why The Federal Deposit Insurance Corporation (FDIC) has stepped in and is now the receiver at SVB. This move would likely prevent a much larger crisis in what is considered one of the largest bank failures since 2008. All assets held in SVB have now been frozen and can only be accessed by insured depositors. However, uninsured depositors will only be gifted a coupon to access part of their money within the next week. With FDIC as the receiver, many of the bank’s employees would not receive their paychecks if they run their payroll through SVB. The main office and all branches of SVB will reopen on Monday, March 13. The FDIC will pay uninsured depositors an advance dividend within the next week. As the FDIC sells all the bank’s assets, future dividend payments may be made to uninsured depositors. Silicon Valley Bank Had Billions In Assets And Deposits As of December 31, 2022, Silicon Valley Bank had approximately $209 billion in total assets and about $175 billion in total deposits. The amount of deposits in excess of the insurance limits is yet to be determined. The number of uninsured deposits will be determined once the FDIC obtains additional information from the bank and its customers. Related Reading: Bitcoin Rally Fueled By USD Coin (USDC) Rotating Into BTC: Santiment The collapse of SVB is a reminder that the traditional finance system is also very fragile, showing the importance of diversification between fiat and digital assets. It’s worth knowing that while the FDIC has stepped in, less than 3% of users are insured, meaning that most customers, around 97%, may be left holding the bag. Feature Image from Jim Wilson/The New York Times, Chart From TradingView

勞倫斯Lepard投資

1投資

勞倫斯Lepard了1投資。他們最新的投資看管銀行作為他們的一部分一個係列在2021年3月3日。

勞倫斯Lepard投資活動

日期 |

輪 |

公司 |

量 |

新的嗎? |

共同投資者 |

來源 |

|---|---|---|---|---|---|---|

|

3/26/2021 |

一個係列 |

看管銀行 |

37美元 |

是的 |

22 |

日期 |

3/26/2021 |

|---|---|

輪 |

一個係列 |

公司 |

看管銀行 |

量 |

37美元 |

新的嗎? |

是的 |

共同投資者 |

|

來源 |

22 |

發現正確的解決方案為您的團隊

CB見解188bet游戏科技市場情報平台分析數百萬數據點在供應商、產品、合作關係,專利來幫助您的團隊發現他們的下一個技術解決方案。